Invest for tomorrow. Live for today.

The Problem

Investment funds held in a stock portfolio feel too distant and in-accessible for daily use.

Investors feel as though they are only investing for the long term and can’t use the value stored in their portfolios to help with everyday purchases.

This causes investors to hold much more cash than they really need for expenses that may or may not eventuate.

Holding too much cash = lower overall return = life feels more expensive than it should.

Introducing Sharer

Sharer is transforming investment accessibility.

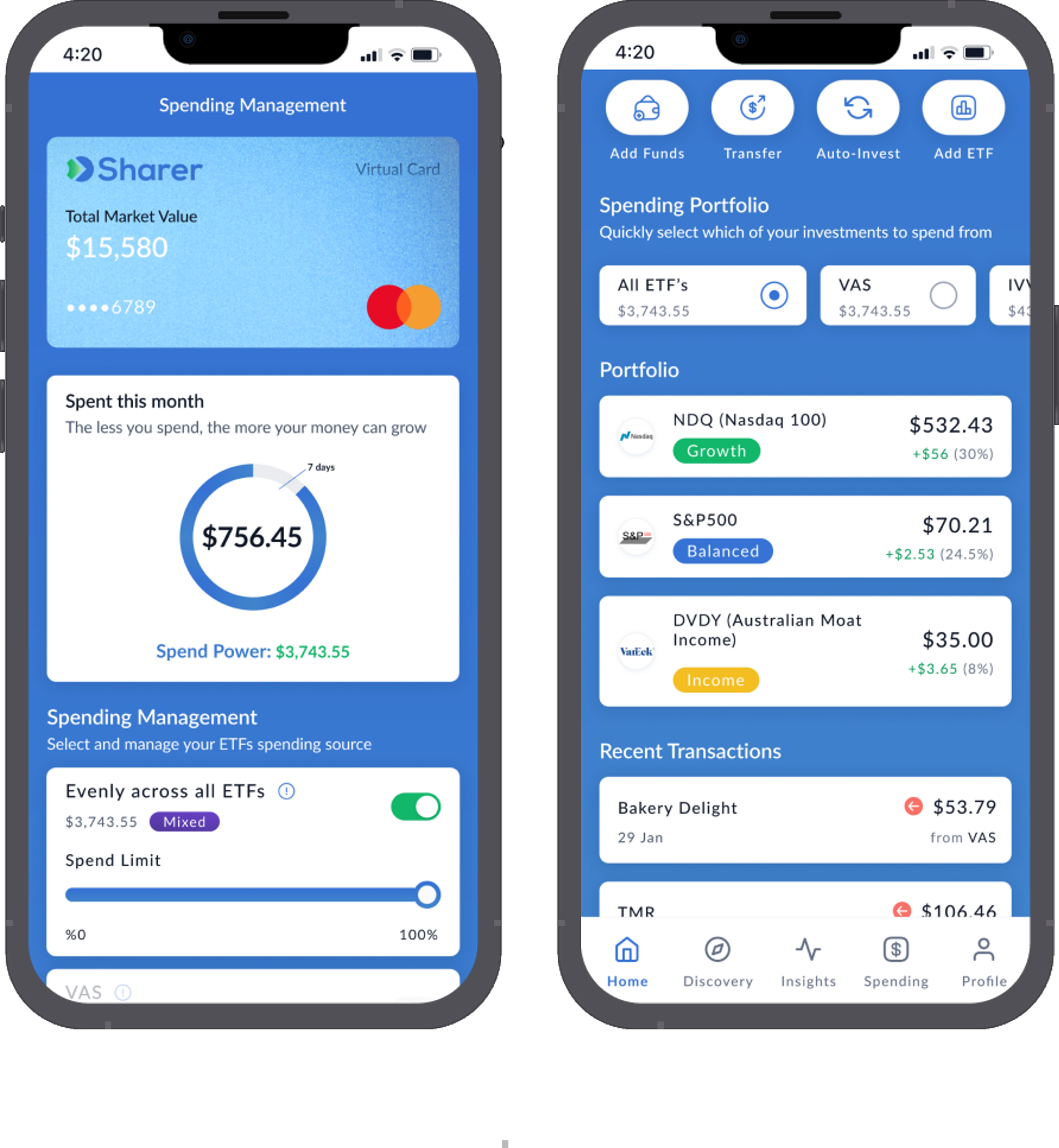

Sharer integrates your investment portfolio with everyday financial transactions, offering a debit card that draws directly from your equity investments, transforming how you view and use your assets.

Sharer Demo Walkthrough

Spend Directly from Your Portfolio

With the Sharer card, spend from your investments as easily as cash.

Enjoy seamless access to your stock portfolio for everyday purchases, blending investment growth with financial flexibility.

Access Unique Investment Solutions

The stock market now offers more than just shares in listed companies. These opportunities have historically only been offered to Australia’s wealthiest families.

Its time to level the playing field.

Sharer will provide users never before experienced access to unique investment options that can cater for income, balanced or growth objectives.

Instant Portfolio Insights

Track and manage your investments in real-time.

Sharer's intuitive app gives you complete control over your investments, allowing for timely decisions and adjustments.

Optimise Your Investment Allocation

Sharer not only facilitates spending from your investments but also helps to guide a more optimal asset allocation.

It encourages a balanced approach to investing, that allows users to hold more of their wealth in growth assets without compromising access or accessibility.

The Future of Finance is Here

With advancements in financial technology and a growing demand for financial autonomy, now is the perfect time for Sharer.

Our solution meets the modern investor's need for flexibility, accessibility, and growth. Recent high levels of Inflation has made investors realize the need to have their money working for them, not against them.

The Team

Daniel is an experienced Finance and Wealth Management professional having spent over 10 years advising some of Australia’s most wealthy individuals and families. Daniel has a distinguished career working with both domestic Private Banks and international Investment Banks. Daniel has expertise in advising clients in portfolio and investment management across all asset classes including equities, fixed income, alternative investments and derivatives. Daniel holds a Bachelor of Psychology from Macquarie University, is a Chartered Financial Analyst (CFA) and holds the RG146 Tier 1 accreditations across all subjects.

FAQ

-

The Spending Portfolio will offer 12, highly diversified ETFs for Income, Balanced and Growth objectives. Users can choose to invest in multiple different ETFs.

-

Yes. You can switch your spending portfolio to another option on the app. Users can choose to spend value equally across all their investments or just select specific ETFs that will be tied to the debt card to fund purchases.

-

Yes. The Sharer Debit Card will function wherever Debit Mastercard is accepted, including physical stores, online, ATMs, and more. You can even schedule your monthly subscriptions like Netflix or Amazon Prime to come directly from your Sharer Debit Card!

-

Purchases with your Sharer Debit Card automatically prompt the app to sell the necessary units from your spending portfolio(s).

Don’t worry, you wont have to wait the standard 2 day settlement period, your purchase on the card will go through immediately.

-

Each investors personal tax position should be discussed with their accountant, however if units in an investment are sold at a profit this will generate capital gains tax.

To minimize the tax liability that our uses will experience, Sharer’s intelligent trading algorithms will automatically sell the oldest units in your spending portfolio. This takes advantage of the 12 month CGT discount (A 50% discount to normal tax paid) to minimize taxes on sales.

Our Mission

Life has become expensive.

Sharer’s mission is to help all investors use the share market more effectively to grow their wealth.

By changing how its users invest, interact and spend their investments, Sharer’s mission is to help all investors make their money work harder for them and reduce the wealth gap.

Join Us on Our Journey

We're seeking strategic partners and investors who share our vision of making investment wealth accessible.

Invest in Sharer to revolutionise the finance industry and unlock the full potential of every investor's portfolio.